Guarding Your Possessions: Trust Structure Know-how at Your Fingertips

In today's intricate monetary landscape, ensuring the protection and growth of your properties is vital. Trust structures function as a foundation for safeguarding your riches and legacy, supplying a structured technique to asset security. Expertise in this world can offer invaluable advice on browsing lawful complexities, making the most of tax obligation effectiveness, and developing a durable economic plan customized to your special needs. By using this specialized understanding, individuals can not only safeguard their assets properly however additionally lay a solid structure for long-term riches conservation. As we check out the intricacies of depend on structure expertise, a globe of opportunities unravels for fortifying your financial future.

Value of Count On Structures

Depend on structures play an essential role in establishing integrity and fostering strong relationships in various specialist setups. Structure trust is crucial for services to flourish, as it develops the basis of successful cooperations and partnerships. When trust exists, individuals really feel much more confident in their communications, resulting in raised efficiency and performance. Trust structures function as the cornerstone for ethical decision-making and transparent communication within organizations. By prioritizing count on, businesses can create a favorable job society where employees really feel valued and appreciated.

Benefits of Specialist Support

Structure on the foundation of count on in specialist relationships, seeking expert guidance offers invaluable benefits for individuals and companies alike. Expert advice provides a riches of understanding and experience that can aid navigate complex economic, lawful, or strategic obstacles effortlessly. By leveraging the competence of specialists in different areas, people and companies can make informed decisions that straighten with their goals and aspirations.

One substantial advantage of professional support is the capacity to gain access to specialized expertise that might not be readily offered or else. Specialists can provide insights and viewpoints that can cause innovative remedies and chances for development. In addition, working with professionals can help reduce dangers and unpredictabilities by supplying a clear roadmap for success.

Furthermore, professional guidance can conserve time and resources by simplifying procedures and avoiding pricey blunders. trust foundations. Professionals can use customized suggestions tailored to specific requirements, ensuring that every decision is well-informed and tactical. In general, the advantages of professional advice are complex, making it a useful property in safeguarding and maximizing possessions for the lengthy term

Ensuring Financial Safety

In the realm of financial planning, protecting a stable and prosperous future joints on strategic decision-making and from this source prudent investment options. Making certain financial protection entails a complex technique that encompasses numerous elements of riches management. One important aspect is producing a diversified investment profile tailored to individual threat resistance and monetary objectives. By spreading out financial investments throughout various possession classes, such as stocks, bonds, actual estate, and products, the danger of significant financial loss can be reduced.

In addition, keeping a reserve is vital to guard versus unanticipated expenses or income interruptions. Experts recommend alloting 3 to 6 months' worth of living expenditures in a liquid, quickly available account. This fund acts as a monetary safety internet, browse around this site providing assurance during turbulent times.

Frequently examining and readjusting monetary strategies in feedback to changing situations is likewise paramount. Life events, market variations, and legal adjustments can impact monetary security, underscoring the value of recurring assessment and adjustment in the quest of lasting economic security - trust foundations. By executing these techniques thoughtfully and consistently, individuals can strengthen their economic footing and job in the direction of a more safe future

Safeguarding Your Possessions Efficiently

With a strong foundation in place for financial protection discover here via diversity and emergency situation fund upkeep, the next important step is safeguarding your possessions efficiently. One reliable approach is possession allowance, which involves spreading your investments across various property classes to lower threat.

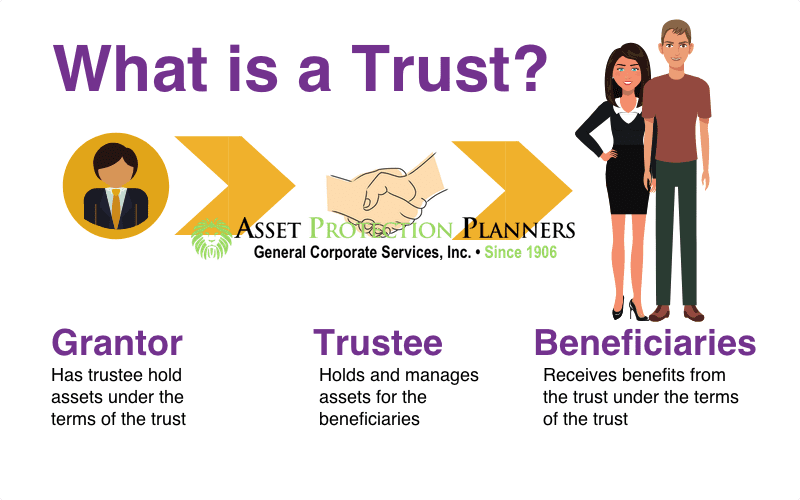

Additionally, establishing a trust can offer a secure means to shield your possessions for future generations. Trusts can aid you manage how your possessions are distributed, lessen inheritance tax, and protect your wide range from financial institutions. By carrying out these methods and seeking specialist advice, you can secure your properties successfully and safeguard your economic future.

Long-Term Asset Protection

To ensure the long lasting protection of your wealth against prospective risks and unpredictabilities over time, tactical preparation for lasting asset protection is necessary. Lasting asset defense includes applying steps to protect your possessions from different hazards such as economic declines, claims, or unforeseen life events. One vital facet of long-lasting property protection is developing a count on, which can offer substantial advantages in shielding your properties from financial institutions and legal disputes. By transferring ownership of possessions to a depend on, you can safeguard them from prospective dangers while still keeping some level of control over their management and distribution.

Moreover, expanding your financial investment profile is another crucial method for long-term property defense. By spreading your financial investments throughout various property classes, markets, and geographical areas, you can minimize the impact of market variations on your overall wealth. In addition, routinely reviewing and upgrading your estate strategy is vital to make certain that your properties are secured according to your desires in the future. By taking a proactive strategy to lasting possession protection, you can guard your riches and offer monetary security for on your own and future generations.

Verdict

In final thought, trust foundations play a critical role in guarding possessions and ensuring monetary security. Expert assistance in establishing and taking care of trust fund frameworks is important for lasting property protection. By making use of the proficiency of experts in this field, individuals can successfully guard their properties and strategy for the future with self-confidence. Trust fund foundations offer a strong framework for safeguarding riches and passing it on to future generations.